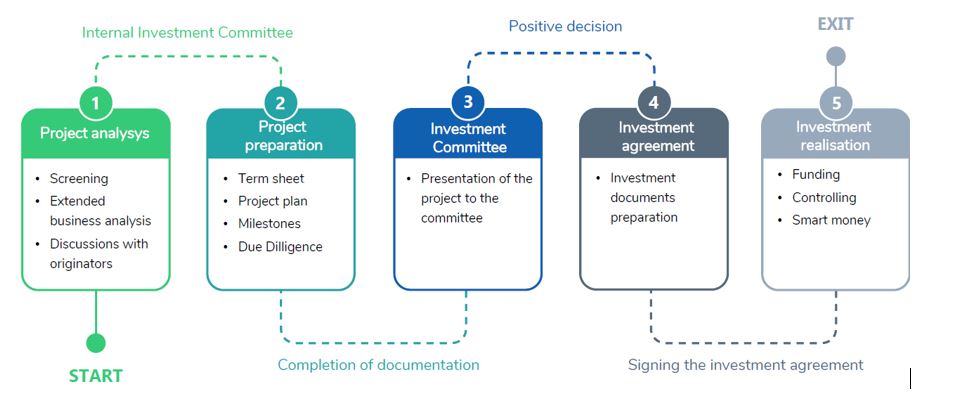

Pitching in front of Investor does not have to be a surprise – on the contrary, it should not be. Good preparation before the first meeting shortens the project analysis process and increases the chances of its positive reception – so it is worth knowing what the investment process looks like from the investor’s perspective.

The following graphic briefly presents the various stages of the investment process along with its characteristic elements:

1.Project Analysis

The first step in the investment process is project analysis, which begins when a proposal is sent to the fund.

The Carlson EVIG Alpha analyst first focuses on matching the project with the fund’s investment policy and meeting the formal conditions resulting from the cooperation with the National Centre for Research and Development under the Bridge Alpha program:

- Matching the fund profile

Projects should be related to following industries: MedTech, ICT, ML/AI, Sensors, Automation and Robotics, CleanTech. They should fit into NSS (National Smart Specialization) : NSS 1, NSS 4, NSS 10, NSS 11.

- Formal requirements

Age of the company and equity relationship, presence of Polish element, SME status, IP ownership.

If a project has investment potential and meets the formal requirements, it is qualified for the next analysis phase, which focuses on the evaluation of:

- experience of the team, completeness of the originators’ competences, presence of scientific staff,,

- competitive advantage, innovation,

- business model, financial projections, method of reaching customers, added value resulting from the product/service,

- market size and reasonableness of assumed market share,

- market fit and interest of potential customers,

- quality of R&D agenda, complexity of the research problem,

- risk analysis covering both economic and R&D,

- attractiveness of the investment offer.

Both the areas of analysis and its duration depend on the specificity of the project, the degree of its substantive preparation and the commitment of its originators. The Fund aims to make a decision as quickly as possible in order to focus its attention on the most interesting projects.

2. Project Preparation

The project analysis ends with a directional decision, which is made by the Internal Investment Committee or the Board of Directors. The fund’s interest is expressed in the proposal to sign a term sheet, a document containing the boundary conditions of the investment. This is the moment to discuss with the investor its corporate role in the company, establish general conditions or confirm the offer. At this stage it is too early to talk about an investment agreement, because the process of its negotiation generates costs on the part of the fund. During the preparation of project documentation and legal and technological due diligence process, facts may come to light that will affect the attractiveness of the project or constitute a deal breaker.

The Project Development Plan (pl. Plan Realizacji Projektu, PRP) is a document describing both the research and economic aspects of the project and comprehensively presents the project implemented under the investment. It presents the profiles of the Originators, describes the research problem, R&D tasks, risks, schedule, milestones and budget. The business part includes a description of the full business model with market analysis, economic viability, financial projections. The PRP must constitute a kind of an independent whole, i.e. it must be coherent and complete enough for its recipient to have no doubts as to its interpretation. The project supervisor, most often the analyst who led the analysis process, actively participates in the work on the document, however, his role comes down to commenting, editing the existing contents

Due Dilligence (abbr. dd or due diligence) is to make reasonable efforts to verify whether the project has no hidden risks that were not detected during the initial analysis. The due diligence is performed at the legal, technological and financial level. The scope of legal due diligence depends largely on the structure of the transaction and focuses on the shareholders / originators of the future company (individuals or legal entities) or intellectual property rights. The purpose of technological due diligence is to verify the assumptions of research and development work, while the financial audit allows to determine whether the company is at risk of insolvency or excessive debt.

Creation of Project Development Plan and the Due Dilligence takes place simultaneously, which requires a high level of coordination. Similarly as in the case of Due Dilligence, time of investment preparation lasts from few to several weeks depending on the project specificity. During the process Investor has an opportunity to see how Originators work, what is their level of engagement, competence and professionalism.

3. Investment Committee

During the Investment Committee representatives of the originators present the project in front of representatives of National Centre for Research and Development and answer their questions

After the Q&A part and discussion an investment decision is made by voting of fund’s representatives and a representative of NCBiR. The NCBiR representative has the right to object to the investment decision if he finds that the project does not meet formal requirements of the Bridge Alpha project.

4. Investment Agreement Negotiations

After a positive decision of the Investment Committee, the phase of preparation and negotiation of investment documentation follows. Just as the Term Sheet indicates the boundary conditions, each aspect of the investment documentation is described in detail. The records specify e.g. the terms of cooperation, corporate governance, rights and obligations of the parties, possibilities of investment exit, as well as individual aspects adjusted to the nature of the project.

5. Project Development

After negotiations are completed and the Investment Agreement is signed, the project is properly implemented according to the Project Plan (PRP) developed at an earlier stage. At the stage of project realization the Fund remains in constant contact with the portfolio company and provides the management team with business and content-related support aimed at building the value of the company, preparing for the commercialization of the product, as well as ensuring further financing. At the end of the project, the originator prepares a report summarizing the implementation of the project including the conducted research and development work. From this point onwards, an investment exit is possible, which, depending on the company’s situation, can take for example the form of an investment by other investor, an IPO or a management buyout.

Author: Emil Arczewski, Business Analyst at Carlson EVIG Alfa